![Advanced Binary Options Trading Strategy With Nadex Call Spreads [Video] nadex binary options spreads strategy](https://i.ytimg.com/vi/-IouydqEUOg/maxresdefault.jpg)

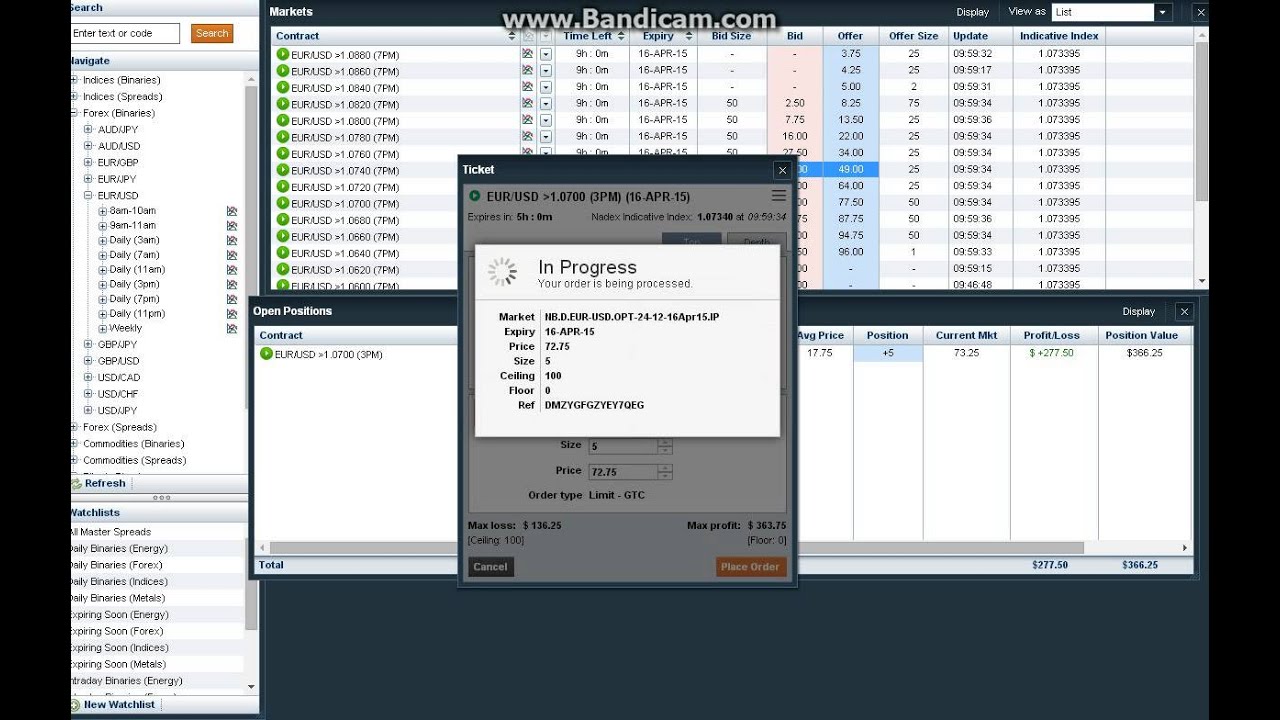

The settlement price on Nadex binary options is 0 or , so the exchange prices will fluctuate between 0 and represents a positive outcome, (so an asset did finish above or below a certain price) and the option will settle at zero where the option had a negative outcome, so for example where the asset price did not finish above the target price 28/2/ · For this advance binary options trading strategy we will use Nadex Call Spreads. The main difference between “regular” Binary Options and Nadex Call Spreads is this: When trading Binary Options, you are simply choosing whether a market is trading above or below a certain level. In order to trade this Binary Option, you pay between $0 and $Reviews: 2 23/9/ · NADEX binary options and spreads offer countless short-term opportunities in all kinds of market environments. NADEX has designed its binary options to work even when the market is flat and it’s generating small market movements. Reason #2: Flexibility The NADEX trading exchange gives you the option to get out of the trades before blogger.comted Reading Time: 8 mins

NADEX Trading Strategies - Binary Options

And in this article, nadex binary options spreads strategy, I want to show you an advanced binary options trading strategy using Nadex Call Spreads. When trading Binary Options, you are simply choosing whether a market is trading above or below a certain level. If the Dow closes above the ceiling, i. And if the Dow closes below the floor, i. So we lose the amount we paid, i.

So if the Dow closes at 27, it would be points above the ceiling. As you can see, there are many advantages to call spreads vs.

Our loss is still capped to the amount we paid for the spread. Let me show you the combined risk graph:. If we enter this trade in the morning when the Dow is at 29, — how likely do you think it is that the Dow CLOSES at this exact level?

As long as the Dow closes between 26, and 27, we lose a little bit of money. Trading Futures, options on futures and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. The lower the day trade margin, the higher the leverage and riskier the trade.

Leverage can work for you as well as against you; it magnifies gains as well as losses. Past performance is not necessarily indicative of future results, nadex binary options spreads strategy. The US Treasury yields rebound amid Fed's hawkishness. ECB policymakers remain divided over PEPP extension. Lagarde and Fedspeak awaited, nadex binary options spreads strategy.

The pound ignores Brexit chaos and delayed economic reopening. Focus on Fedspeak amid a light calendar, nadex binary options spreads strategy.

After making a low at Yen limits losses on its safe haven appeal despite BOJ no show. XRP price has formed a bearish outlook after breaking below the neckline of the head-and-shoulders pattern that has started to develop since late May.

Now that the big Fed meeting is out of the way markets can relax for the summer months ahead. The Fed was in accommodative nadex binary options spreads strategy in terms of nadex binary options spreads strategy if not policy. Discover how to make money in forex is easy if you know how the bankers trade! In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news Chart patterns are one of the most effective trading tools for a trader.

They are pure price-action, and form on the basis of underlying buying and The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a nadex binary options spreads strategy bought from the money taken from forex traders. So, how can we avoid falling in such forex scams?

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10, hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process. LATEST FOREX NEWS Forex News Institutional Research.

SECTIONS Latest Analysis. TOOLS Economic Calendar Interest Rates Market Hours. TOP EVENTS Coronavirus Brexit Nonfarm Payrolls Fed BoC ECB BoE BoJ RBA RBNZ SNB. SECTIONS Bitcoin Ethereum Ripple Litecoin Bitcoin Cash Cardano Stellar VeChain Chainlink.

SECTIONS Latest Live Videos Shows Schedule Become Premium. MOST POPULAR COACHES Ed Ponsi Giuseppe Basile Sarid Harper Alex Ong Sam Seiden Steve Ruffley Rob Colville Nenad Kerkez Gonçalo Moreira Navin Prithyani David Pegler Walter Peters.

SECTIONS Forex Brokers Broker News Broker Spreads. Wall Street Week Ahead: Bullard tries to wake the bears but bulls stumble on. Money Management.

Learn To Day Trade Nadex \

, time: 11:45Nadex review - Call spreads, Strategy, Demo and How To's

The settlement price on Nadex binary options is 0 or , so the exchange prices will fluctuate between 0 and represents a positive outcome, (so an asset did finish above or below a certain price) and the option will settle at zero where the option had a negative outcome, so for example where the asset price did not finish above the target price 28/2/ · For this advance binary options trading strategy we will use Nadex Call Spreads. The main difference between “regular” Binary Options and Nadex Call Spreads is this: When trading Binary Options, you are simply choosing whether a market is trading above or below a certain level. In order to trade this Binary Option, you pay between $0 and $Reviews: 2 23/9/ · NADEX binary options and spreads offer countless short-term opportunities in all kinds of market environments. NADEX has designed its binary options to work even when the market is flat and it’s generating small market movements. Reason #2: Flexibility The NADEX trading exchange gives you the option to get out of the trades before blogger.comted Reading Time: 8 mins

No comments:

Post a Comment